REFI SUN

Key investment highlights

Experienced management team with proven track record

• Fund Partners have participated in over EUR 300 million transactions in CEE region.

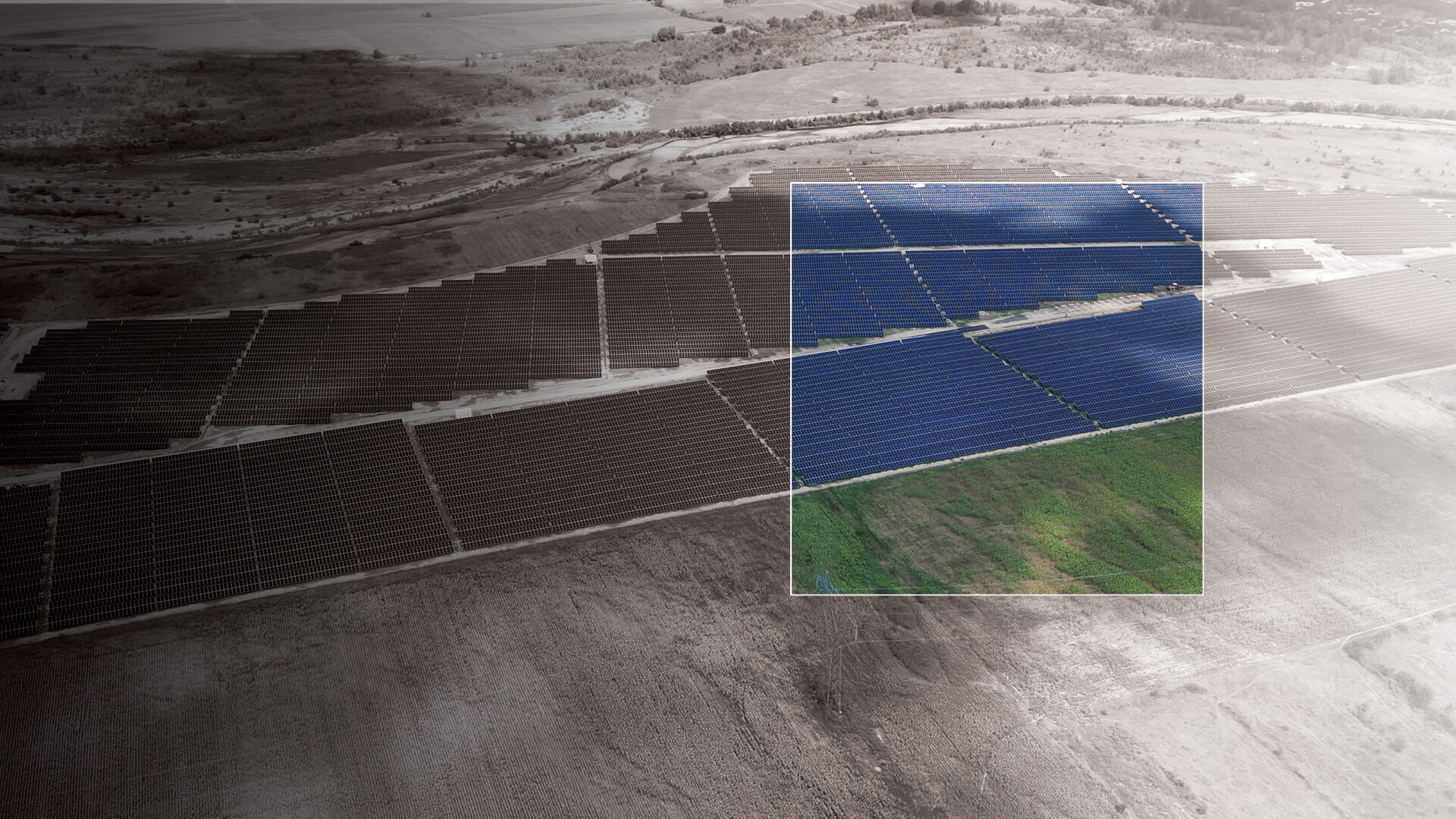

• Invalda INVL Group investments through REFI and other funds in Romania alone reaches over EUR 400 million.

Mature target markets

• Established CfD schemes enable predictable cash flows and strong exit liquidity compared to Baltic region.

• Electricity prices remain 10-20% higher during 2024-2025 in Poland and Romania compared to Baltic markets.

Sale of project portfolio in progress

• Romanian portfolio is undergoing due diligence with a potential buyer, targeting exit at commercial operation date.

• Polish portfolio has received and accepted non-binding offer; portfolio is under preparation for due diligence process.

Portfolio income hedge

• 90% of the Polish portfolio's revenue is secured by government-backed, 15-year indexed CfD contracts, ensuring stable, inflation-linked returns.

• Several Romanian portfolio projects are in the process of securing PPA contracts.

Secured construction financing

• Over EUR 78 million in construction financing secured from EBRD and top-tier lenders for 3 Romanian projects; the fourth project is in advanced term sheet phase, supporting full pipeline execution.

Timeline

- Start of Offering 28 July 2025

- End of Offering 15 August 2025

- Announcement of Results 19 August 2025

- Settlement Date 19 August 2025

- Bond Maturity Date 19 February 2028

Financial information and statements

Frequently asked questions

The bonds are ordinary, secured fixedrate bonds issued by a private entity – REFI Sun and unconditionally and irrevocably guaranteed by INVL Renewable Energy Fund I, a fund actively investing in renewable energy assets in Central and Eastern Europe.

The offering is a public placement open to investors in Lithuania, Latvia, and Estonia.

Total programme size: Up to EUR 25,000,000 (25,000 bonds with a nominal value of EUR 1,000 each).

First tranche: Up to EUR 15,000,000.

First tranche subscription period:28 July 2025 09:00 – 15 August 2025 15:30, Vilnius time.

Issue date:19 August 2025.

You must submit your subscription order through one of the lead managers before the end of the subscription period.

1. Choose a distributing bank or investment firm:

AB Artea bankas – broker@artea.lt, +370 52 103 354

AS LHV Pank – ib@lhv.ee, +372 56 206 450

AS Signet Bank – investmentbanking@signetbank.com, +371 62 102 911

UAB FMĮ Evernord – vismante.sepetiene@evernord.com, +370 68 668 3822.

2. Fill in the subscription order and transfer the required funds (minimum EUR 1,000).

3. Orders are processed during the subscription period, and you will receive confirmation after allocation.

19 February 2028. Unless redeemed early, the issuer repays the principal in full on this date.

No, issuer will not extend the term of the bonds. The existing bonds would be refinanced by issuance of new bonds and investors would be able to decide if they want to acquire new bonds.

Annual coupon: 7.5% – 8.5% per year (final rate set by the auction).

Interest calculation method: actual/365 on the nominal value.

Interest payment dates: 19 February, 19 May, 19 August, 19 November each year.

Record date: Bondholders registered 3 business days before the payment date receive interest.

Example:

If you buy 10 bonds (EUR 10,000 nominal) and the coupon is set at 8.0%, your annual interest is EUR 800, paid quarterly (~EUR 200 per payment).

The bonds are secured by assets of the issuer and guaranteed by INVL Renewable Energy Fund I, a well-established fund with a portfolio of renewable energy projects. This means that if the issuer fails to meet obligations, the guarantor is legally bound to fulfill them.

Proceeds will be used to:

Refinance existing loans of the Group companies, and

Finance construction of a 10 MW photovoltaic (PV) project in Poland.The PV project is expected to contribute to stable cash flows supporting interest and principal payments.

Issuer’s call:

Possible after 6 months from the issue date, with 14 days’ notice.

Redemption price: nominal value + accrued interest.

- If redeemed between months 6–12: +1.00% premium.

- If redeemed after 12 months: no premium.

Bondholder’s put option:

If at least 75% of the bonds are redeemed (via bondholder put option), remaining bonds redeemed by the issuer include a 2% premium.

Example:

If you hold EUR 10,000 nominal and the issuer calls after 8 months:

You receive EUR 10,000 + EUR ~533 interest (8 months at 8%) + EUR 100 premium (1%).

The issuer has agreed to:

Negative borrowing – no additional borrowing from unrelated parties.

Negative pledge – no pledging of directly owned assets.

Change of control protection – if INVL Renewable Energy Fund I ceases to own 50% + 1 share, investors may exercise put option.

Restriction on asset disposals – no asset sales that would materially harm the issuer’s ability to meet obligations.

Reporting obligations – annual and semi-annual reports of issuer and guarantor.

Business continuity – no material changes to the nature of business.

On Nasdaq First North within 3 months of issue. This listing facilitates potential secondary market trading, though market liquidity cannot be guaranteed.

All investments carry risks. Key risks include:

Credit risk: The issuer or guarantor might default. Mitigated by the guarantee and security.

Market/interest rate risk: Bond prices may fluctuate if market rates rise or fall.

Liquidity risk: While bonds will be listed, trading volumes may be limited.

Early redemption risk: Bonds may be redeemed before maturity, possibly reducing expected returns.

Project risk: Unexpected construction or operational issues could impact cash flow.

Regulatory risk: Changes in laws or taxes affecting returns.For a full description, please refer to the official prospectus.

Nominal value per bond: EUR 1,000.

Minimum investment: EUR 1,000 (one bond).Subscriptions should be in multiples of EUR 1,000.

Trustee: UAB “Audifina” (acts on behalf of bondholders).

Lead managers/bookrunners: AB Artea bankas, AS LHV Pank, AS Signet Bank, UAB FMĮ Evernord.

Settlement agent: AB Artea bankas.

Legal advisor: Sorainen and Partners.

Attractive fixed interest rate (7.5%–8.5%).

Backed by an experienced renewable energy fund.

Public offering with planned listing on Nasdaq First North.

Covenants and guarantees providing investor protection.

Direct contribution to green energy infrastructure in the region.

Šiame puslapyje pateikiama bendro pobūdžio rinkodaros informacija, kuri nėra pritaikyta jokio konkretaus asmens individualioms aplinkybėms, finansinei padėčiai ar poreikiams. Ji nėra ir negali būti laikoma pasiūlymu (oferta) įsigyti kolektyvinio investavimo subjekto vienetų, obligacijų ar kitų vertybinių popierių, taip pat raginimu teikti pasiūlymą pasirašyti ar įsigyti bet kokius vertybinius popierius. Tai taip pat nelaikytina investavimo patarimu, investavimo rekomendacija ar investiciniu tyrimu.

Informacija nebuvo parengta atsižvelgiant į jokius konkrečius investavimo tikslus, finansinę situaciją ar individualius poreikius. Ji pateikiama tik bendro pobūdžio informaciniais tikslais ir neturėtų būti laikoma išsamia, tiksli ar atnaujinta informacija, taip pat pakankama kaip

pagrindas priimti investicinius ar kitus sprendimus. Joks asmuo neturėtų remtis šiame puslapyje pateikta informacija. Informacija gali būti keičiama be atskiro įspėjimo.

Ši informacija nėra vertybinių popierių platinimo pasiūlymas ar kvietimas pirkti vertybinius popierius jokioje jurisdikcijoje, taip pat tai nėra prospektas, kaip jis apibrėžiamas 2017 m. birželio 14 d. Europos Parlamento ir Tarybos reglamente (ES) 2017/1129. Bet koks šiame puslapyje nurodytų vertybinių popierių – pavyzdžiui, obligacijų – pasirašymas ar įsigijimas gali būti vykdomas tik remiantis oficialiame siūlymo prospekte pateikta informacija. Prieš pasirašydami ar įsigydami obligacijas, asmenys turėtų atidžiai susipažinti su prospekte pateikta rizikos informacija ir ją įvertinti.

Jokia čia pateikta informacija nėra ir negali būti laikoma rekomendacija ar teisine, finansine, investicine ar mokesčių konsultacija. Nei ši informacija (ar jos dalis), nei jos platinimas negali būti pagrindas sudaryti kokią nors sutartį ar būti laikoma pagrindu investiciniam sprendimui. Prieš priimdami bet kokį investicinį sprendimą, potencialūs investuotojai turėtų pasitarti su kvalifikuotu ir leidimą teikti investavimo konsultacijas turinčiu patarėju.

Investicijos į obligacijas ar kitus vertybinius popierius gali būti susijusios su didele rizika, įskaitant visos investuotos sumos praradimą. Tokios investicijos vertė gali tiek mažėti, tiek didėti. Prieš priimdami sprendimą investuoti, potencialūs investuotojai turėtų įvertinti investicijos tinkamumą atsižvelgdami į savo asmeninę situaciją, geriausia – pasikonsultavę su finansų ar kitu profesionaliu patarėju.